The Ghana Revenue Authority (GRA) has responded to concerns expressed by the Abossey Okai Spare Parts Traders Association regarding the implementation of the new Value Added Tax (VAT) regime under the Value Added Tax Act, 2025 (Act 1151).

The GRA insists that this policy will not lead to higher consumer prices.

In its statement, the GRA emphasised that it takes the concerns of all taxpayers seriously and remains open to constructive dialogue. However, it noted that the claims made in the Association's statement demonstrate a fundamental misunderstanding of how the new VAT system operates.

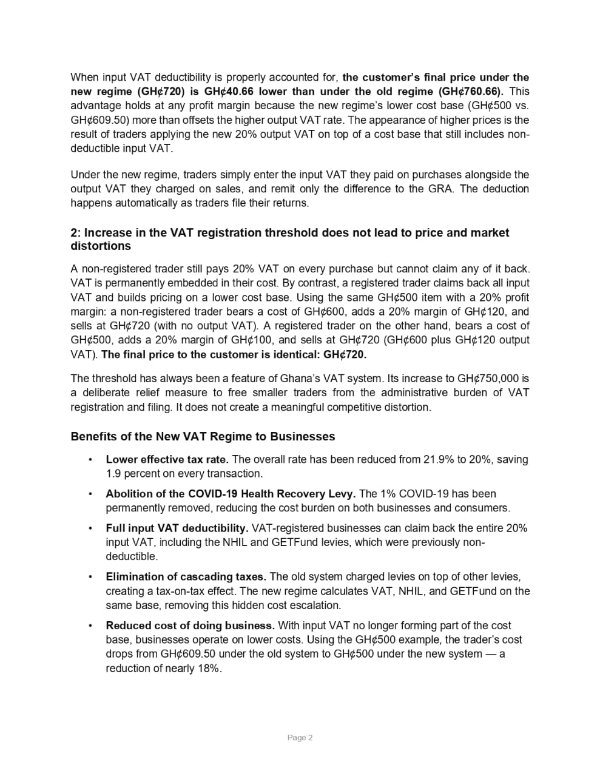

To clarify, the Authority outlined several key points: "The change from the 4% Flat Rate to 20% will not result in increased prices."

It further explained that under the Flat Rate Scheme, traders paid an input VAT of 21.9% on every purchase, which was not deductible. Under the new regime, input VAT of 20% is fully deductible, allowing traders to reclaim it from the GRA, which subsequently results in lower costs.

The GRA remains committed to ensuring a fair implementation of the new VAT regime and encourages ongoing engagement with stakeholders.

Comments (0)

No comments yet. Be the first to comment!